This memo was prepared by Nancy Smith, Executive Director of GrowSmart Maine, and select information was presented at a 11.13.17 Roundtable discussion hosted by Congresswoman Chellie Pingree in Portland, Maine. See bottom of this page for a link to the video of the roundtable discussion.

As Congress prepares to debate tax reform, GrowSmart Maine wishes to highlight the economic value of two tax credits at risk; the Historic Tax Credit and Low-Income Housing Tax Credit.

Preserve Historic Tax Credits!

The Republican leadership’s outline for tax reform, meant to guide the legislative process, failed to retain the historic tax credit (HTC), despite its success over its more than 35-year history of revitalizing small towns, creating jobs, and increasing economic activity, all while returning more tax revenue to the Treasury than it costs.

Without the federal tax HTC, our Maine State Tax Credit could also be at risk, and Maine’s historic towns, cities, and Main Streets could lose an essential tool that helps drive economic growth.

The HTC has helped revitalize historic buildings in Greater Portland and across Maine. Tax reform must not come at the expense of a program that more than pays for itself and has a proven track record of creating jobs, saving historic buildings, and bringing new vitality to our communities!

“No state enjoys a more glorious and abundant legacy of historic structures than Maine. These inspiring civic, religious, residential, commercial, and industrial buildings enhance our urban and rural landscapes from Kittery to Fort Kent, from East Wilton to Eastport. They are the heart and soul of Maine today and tomorrow, powerful reminders of our past, and critical assets that drive our economic future. Nothing is more important to their future than the Federal and State Historic Tax Credit programs that make possible their maintenance, rehabilitation, and timely re-use for future generations. (Richard Barringer, Emeritus Professor, Muskie School of Public Service, USM)

The State program, begun in 2007-08, builds directly upon the Federal; and a careful 2011 evaluation of the State program, done while Maine was deep in recovery from the Great Recession, found that “Maine’s State Historic Tax Credit program has performed well so far. It has stimulated construction activity and jobs, even as the rest of the real estate industry has slumped. Over the long term (its) continuation will support jobs and income, build Maine’s quality of place image, and generate a positive fiscal impact for state and local government revenues.”(See Planning Decisions, Inc, The Economic and Fiscal Impacts on Maine of Historic Preservation and the State Historic Preservation Tax Credit, April 21, 2011.”)

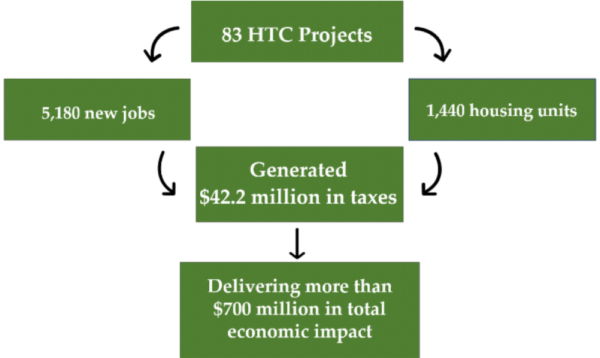

Economic Impact of Historic Tax Credits, state and federal, in Maine Since 2008

The historic tax credit enjoys strong bipartisan support. This was demonstrated this past summer, when Congressional Representatives Pingree and Poliquin signed on as sponsor’s of Sen. Collins’ bill to strengthen the small projects component of this program.

Low-Income Housing Tax Credit also at risk

While I’m pleased the proposal preserves the 9% low income housing tax credit (LIHTC) program, it eliminates the 4% LIHTC program by eliminating the tax exemption on private-activity bonds. This loss will reduce the construction of workforce housing which is a critical need in much of Maine. It also reduces the value of 9% credits by lowering the corporate tax rate from 35% to 20% without adopting any provisions that would serve to soften the impact on the LIHTC program.

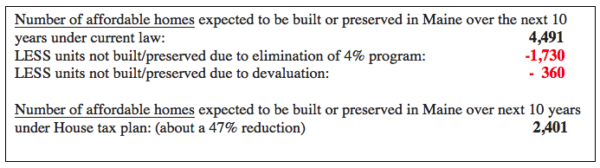

Over the past 17 years, 38.5% of the affordable homes built or preserved in Maine have been financed through the 4% LIHTC program, which requires the use of the tax-exempt housing bonds that would be eliminated under the House tax reform plan. If that tax change is signed into law, the number of affordable homes that we expect would be created or preserved over the next 10 years in Maine would be reduced by 1,730 units, from 4,491 to 2,761.

Over the past 17 years, 38.5% of the affordable homes built or preserved in Maine have been financed through the 4% LIHTC program, which requires the use of the tax-exempt housing bonds that would be eliminated under the House tax reform plan. If that tax change is signed into law, the number of affordable homes that we expect would be created or preserved over the next 10 years in Maine would be reduced by 1,730 units, from 4,491 to 2,761.

The House plan also proposes to lower the corporate tax rate from 35% to 20%, which would decrease the value of low income housing tax credits from about 95 cents to about 80 cents per dollar of credit. That reduction in tax credit equity is expected to result in a further reduction of approximately 360 affordable homes built or preserved in Maine over the next 10 years.

In total, these two tax changes would cause an overall reduction of 2,090 affordable homes built or preserved in Maine over the next 10 years, a 47% drop from expected productivity under current tax law.

(LIHTC figures updated 11.16.2017)

Speaking more broadly, this tax cut plan increases the federal deficit significantly, placing additional pressure on all discretionary, non-defense programs. In our outreach to Maine’s Congressional delegation, we highlighted several that have demonstrated significant statewide impact:

- Community Development Block Grants

- Brownfield Restoration

- EPA Smart Communities Programs

- TIGER Transportation grants

- USDA: Rural Development

Contents for this information sheet gathered from Maine Preservation, Greater Portland Landmarks and Portland Society of Architects, and Maine Affordable Housing Coalition.

Watch the Roundtable Discussion on Facebook by visiting the 11.13.17 post on GrowSmart Maine’s Page or this link.![]()